Happy April! This year, spring started on March 20. I wish you a wonderful spring season. Whatever personals goals you have for 2017, I hope you are well on your way to accomplish them.

I want to share a Central Florida market snapshot with you.

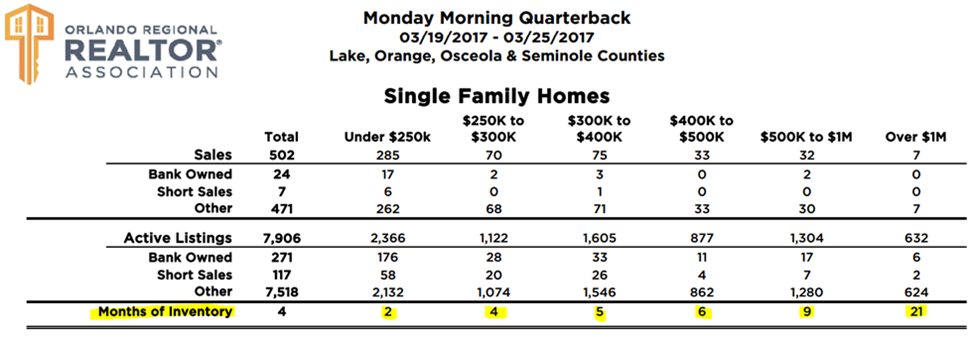

This is a quick look at the sales and active listings in our MLS.

The listing composition of our residential real estate market is:

- 95% “normal” listings.

- 4% bank-owned (foreclosure) listings.

- 5% short sale listings.

So, we have a healthy balance of 95% traditional offerings, and 5% (foreclosure + short sales) distressed listings. This is a far cry from the years when our market was 75% distressed sales.

You have heard me describe the “tale of three markets” in Orlando. That is, for homes under $300,000, we are in a seller’s market, where the seller has advantage and leverage over the buyers. At the price range between $300,000 and $500,000, we are in a balanced market, where neither seller nor buyer has undue advantage over the other. Above $500,000, we are actually in a buyer’s market, where the buyer has advantage and leverage over the seller.

This table also illustrates this effect. Please take a look at the highlighted portion at the bottom of the table. Months-of-inventory means the number of months it would take to sell all the existing active listings. This indicates the supply-and-demand dynamic. The long-term average of a balanced market is between 5-6 months of inventory.

- As you can see, under $250k, there is only a 2-month supply of housing inventory. This is where the demand outpaces the supply, hence the resulting “seller’s market”

- Between $250k – $300k, we have a 4-month supply. So we are still in a Seller’s market, but not as heated.

- Between $300k – $500k, we have a 5-6 month supply. This is the balanced segment.

- From $500k – $1M, we see a 9-month supply. This clearly tilts to a buyer’s market.

- Over $1M, there is a 21-month supply. This is a strong buyer’s market.

If you are looking to buy or sell a home in 2017, let us brainstorm with you to come up with the best strategy.

If you are looking to buy a home below $300,000, we will do everything we can to improve your odds in the challenging seller’s market.

If you are upsizing and buying a higher priced home, you may be selling your current home in a seller’s market, but buying the next one in a buyer’s market. This may turn out to be an ideal situation.

If you are downsizing, you may be selling in a buyer’s market, but will be buying in a more competitive seller’s market.

In all the situations, you can benefit from our experience and expertise. We are not sales-people. We are consultants. We take pride in using our know-how to maximize your outcome. We appreciate the opportunity and your continuing trust.

Give us a call if you have questions, or know of someone we can help!

Until next month, take care!

Yien and the Yao Team.