Happy month of May! This May carries special significance in Central Florida as we are tiptoeing into phase 1 of lifting stay-at-home restrictions. The timing is great, as we are entering the early phase of the peak real estate buying/selling season in Orlando. Will we recover quickly due to pent-up demand or will economic fallout cascade into the housing market? Only time will tell how this season will work out.

The consequence of the lifting of restrictions is uncharted territory, so we are staying vigilant and continuing our carefully honed safety procedures for helping people buy and sell houses during this coronavirus pandemic.

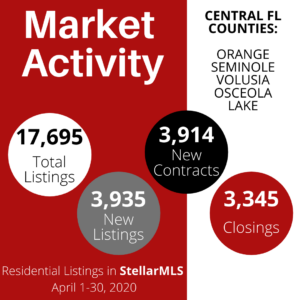

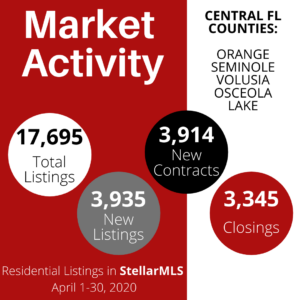

We want to share with you some of the latest local housing stats to show you that the market is still active. People are still buying and selling houses!

In the Greater Orlando area, there were 17,695 total listings at the end of April. With 3,345 closings, that equates to 5.29 months worth of housing inventory. This number denotes a balanced market. There were 3,935 new listings in April, so we can see that the sellers are still in the market. We also see 3,914 new contracts, which means the buyers are also still in the market. In summary, the housing market is still holding together, even before the lifting of restrictions. Because the housing market is an important component of our GDP and economy, we hope this housing market strength continues as we move forward in this pandemic crisis.

If you are thinking about buying or selling a home, give us a call. Let our experience and expertise in the current market go to work for you!

In parting, we want to share with you a short article about the current state of the mortgage market. Right now it is at the lowest point in the past 50 years. We hope this can offer further incentive for home buying to sustain the housing market.

By Kerry Smith

The pandemic-slowed economy pushed the average 30-year mortgage rate to its lowest point in at least 50 years – since Freddie Mac started tracking rates in 1971.

WASHINGTON – The pandemic-slowed U.S. economy pushed the average 30-year mortgage rate to its lowest point in at least 50 years, according to Freddie Mac, which started tracking rates in 1971.

The size and depth of the secondary mortgage market is helping keep rates at record lows, Freddie Mac says. Today’s low rates are driving higher refinance activity and a modest uptick in demand for new-home purchases.

However, not everyone can take advantage of today’s low rates. In some cases, banks have tightened lending restrictions and are making loans only to well-qualified buyers or home refinancers. In addition, some potential homebuyers in January are now out of work as applications for unemployment skyrocket.

At 3.23%, the average 30-year fixed-rate mortgage is down 0.10% week-to-week (from 3.23%) and 0.91% compared to this same time last year.

The 15-year fixed-rate mortgage dropped to 2.77% this week. That’s down .0.09% from last week (from 2.86%) and down 0.83% year-to-year.

The 5/1 hybrid adjustable-rate mortgage averaged 3.14 % this week.

Economists at Fannie Mae predicted this week that 30-year rates could go as low as 2.9% in 2021, however it’s unclear yet what effect the COVID-19 pandemic will have over the long term.

“In our view, the negative shock will apply to both the home purchase and rental markets. On the demand side, early indications are that the purchasing benefit of lower interest rates are being offset by the downturn in employment,” says Doug Duncan, senior vice president and chief economist at Fannie Mae.

“On the supply side, the number of listings is falling, as those with homes to offer may either be hesitant to allow strangers to tour their home or worry that the lack of demand is placing downward pressure on the sales price they might otherwise receive,” Duncan adds.

© 2020 Florida Realtors®

Please let us know if you have any real estate related questions. As always, we are happy to help and excited to talk with you.