Happy month of June! We hope this newsletter finds you and your loved ones healthy and creatively happy during this unusual time!

There is much uncertainty as to the potential economic impact of this coronavirus pandemic. In times of market uncertainty, we can often look to real estate as a safe harbor. If you do not own a home, consider the current advantageous buying opportunity of the extremely low mortgage interest rate. If you want a more stable investment for your money other than the volatile stock market, consider the soundness of buying rental properties with positive cash flow.

Last month carried special significance in Central Florida as we tiptoed into phase 1 of lifting stay-at-home restrictions. The timing was great, as we were entering the early phase of the peak real estate buying/selling season in Orlando. Would we recover quickly due to pent-up demand or would the economic fallout cascade into the housing market? Only time would tell how this season would work out.

One month later, we are now happy to report that we are seeing a resurgence of real estate demand after two months of understandable reduced activity. Buyers and sellers are out in full force and our team is busier than ever helping home buyers and sellers!

Of course, the consequences of lifting restrictions are still uncharted territory, so we are staying vigilant and continuing our carefully honed safety procedures for helping people buy and sell houses during this pandemic.

If you have been thinking about buying or selling a home this year, don’t wait. Give us a call right now! We will provide you the inside market information and what we have learned in the last three months.

Happy month of May! This May carries special significance in Central Florida as we are tiptoeing into phase 1 of lifting stay-at-home restrictions. The timing is great, as we are entering the early phase of the peak real estate buying/selling season in Orlando. Will we recover quickly due to pent-up demand or will economic fallout cascade into the housing market? Only time will tell how this season will work out.

The consequence of the lifting of restrictions is uncharted territory, so we are staying vigilant and continuing our carefully honed safety procedures for helping people buy and sell houses during this coronavirus pandemic.

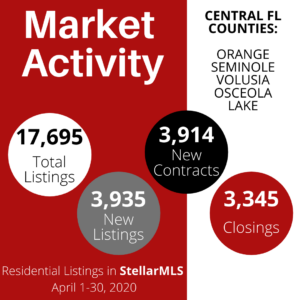

We want to share with you some of the latest local housing stats to show you that the market is still active. People are still buying and selling houses!

In the Greater Orlando area, there were 17,695 total listings at the end of April. With 3,345 closings, that equates to 5.29 months worth of housing inventory. This number denotes a balanced market. There were 3,935 new listings in April, so we can see that the sellers are still in the market. We also see 3,914 new contracts, which means the buyers are also still in the market. In summary, the housing market is still holding together, even before the lifting of restrictions. Because the housing market is an important component of our GDP and economy, we hope this housing market strength continues as we move forward in this pandemic crisis.

If you are thinking about buying or selling a home, give us a call. Let our experience and expertise in the current market go to work for you!

In parting, we want to share with you a short article about the current state of the mortgage market. Right now it is at the lowest point in the past 50 years. We hope this can offer further incentive for home buying to sustain the housing market.

By Kerry Smith

The pandemic-slowed economy pushed the average 30-year mortgage rate to its lowest point in at least 50 years – since Freddie Mac started tracking rates in 1971.

WASHINGTON – The pandemic-slowed U.S. economy pushed the average 30-year mortgage rate to its lowest point in at least 50 years, according to Freddie Mac, which started tracking rates in 1971.

The size and depth of the secondary mortgage market is helping keep rates at record lows, Freddie Mac says. Today’s low rates are driving higher refinance activity and a modest uptick in demand for new-home purchases.

However, not everyone can take advantage of today’s low rates. In some cases, banks have tightened lending restrictions and are making loans only to well-qualified buyers or home refinancers. In addition, some potential homebuyers in January are now out of work as applications for unemployment skyrocket.

At 3.23%, the average 30-year fixed-rate mortgage is down 0.10% week-to-week (from 3.23%) and 0.91% compared to this same time last year.

The 15-year fixed-rate mortgage dropped to 2.77% this week. That’s down .0.09% from last week (from 2.86%) and down 0.83% year-to-year.

The 5/1 hybrid adjustable-rate mortgage averaged 3.14 % this week.

Economists at Fannie Mae predicted this week that 30-year rates could go as low as 2.9% in 2021, however it’s unclear yet what effect the COVID-19 pandemic will have over the long term.

“In our view, the negative shock will apply to both the home purchase and rental markets. On the demand side, early indications are that the purchasing benefit of lower interest rates are being offset by the downturn in employment,” says Doug Duncan, senior vice president and chief economist at Fannie Mae.

“On the supply side, the number of listings is falling, as those with homes to offer may either be hesitant to allow strangers to tour their home or worry that the lack of demand is placing downward pressure on the sales price they might otherwise receive,” Duncan adds.

© 2020 Florida Realtors®

Please let us know if you have any real estate related questions. As always, we are happy to help and excited to talk with you.

Real estate is deemed an essential service so we are still operating. Our team is working from home via teleconferencing technology and, when we do conduct our services in person, we observe all CDC and common sense precautions. To give you an idea of how we show homes safely, we:

(1) Teleconference to discuss properties with clients virtually whenever possible.

(2) Video or stream virtual walk-throughs upon clients’ request.

(3) For in-person viewings:

We advise continued patience as we venture together into this unprecedented territory. We have always taken pride in our online marketing for our sellers, which is more important than ever under present circumstances. If you need to sell your home, we will work with you to properly prepare your home before listing. We will make your home stand out online and we will help you coordinate safe showings that follow social distancing guidelines. Managing contracts has also become more critical than ever, as multiple factors at play increase the uncertainty of closing. Know that we continue to be up to date on the latest market info with affiliated professionals including lenders, title, and closing agents. We will do everything in our power to achieve the most favorable outcome for you.

We hope to be on the other side of this pandemic soon. Please reach out to us. We would love to hear from you and discuss your questions or concerns.

Please take good care of yourself and your loved ones.

There is much uncertainty as to the potential economic impact of the developing coronavirus situation. In time of market uncertainty, we can often look to real estate as a safe harbor. If you do not own a home, consider the current advantageous buying opportunity of the extremely low mortgage interest rate. If you want a more stable investment for your money in the volatile stock market, consider the soundness of buying rental properties with positive cash flow.

Last month we talked about ways to start preparing to sell a home. This month, we’re going to focus on what potential buyers should be doing now to get ready to purchase a home this summer. If you know anyone who is thinking they’re ready to become a homeowner, please share this information with them!

Here are our 4 best tips to start getting ready now for your future purchase:

If you have questions or would like personalized guidance, call us. We love to help!

Until next month, take care!

If your goals include selling a home this year, then this article is for you. And if you know anyone who is thinking of selling, please share this information with them, we’d love to give them the advantage with these great tips! If you are thinking about buying a home, stay tuned for next month’s article, or better yet, give us a call today!

The Orlando housing market has seasonal momentum, and real estate sales really heat up during the Spring-Summer seasons. For this reason, many sellers try to list during these peak months. If you want to sell quickly, for the highest possible price, then now is the time to start preparing your home! More prepared the home is, better the outcome of the sale. The following are our best tips for things you can start doing today to prepare your home for the market.

Of course, this is not an exhaustive list. It is always helpful to give us a call first. We can evaluate your home and prepare a detailed, customized plan to prepare your home. We can even provide resources to help you get the work done.

Until next month, take care!

We hope 2019 was a good and memorable year for you. As we enter 2020, we wish you the full optimism, energy, and momentum that comes with the arrival of a brand-new year! We have been updating and sharing with you this list each year as a matter of tradition and, as we do so, we continue to hope that real estate can be the foundation of your financial security. Does real estate figure into your 2020 New Year’s resolution? Here are some suggestions for consideration in your real estate related resolutions:

Homeownership is still the quintessential American dream and is also the top goal of most Millennials. Homeownership represents the foundation of personal freedom and also serves as a major asset for families and individuals. Since we all need a place to live, we can either rent or we can own. Owning is the first step to building equity. Many of us have built our wealth through it. However, owning a home does come with a lot of responsibilities and isn’t for everyone. Are you ready to take this step in 2020 for your financial future? We can help you get started.

Do ever-changing priorities and plans have you thinking about selling your home? Is it time to re-evaluate your investment properties? In this matured housing market, it’s important to have a professional consultation when thinking about selling. During seller consultations, one very important question we answer is when to act. In a rising market, time is on the Seller’s side. In a declining market, sooner is better than later. We watch and analyze the market closely and are happy to share with you our insights so that you can make the most informed decision.

Our needs and wants can change over time, and where we live can dictate the quality of these many aspects. Do you dream of a different type of property or location? The ideal home is different for everyone. We’ve helped a family move out of a rigid HOA community and into a custom home on acreage. We’ve helped a family build their dream home on a lakefront lot where they watch sunsets over water and ski to their hearts’ content. We’ve had clients that moved to Downtown Orlando, scenic Mount Dora, beautiful Winter Park, and oak-shaded Winter Springs where they experienced a renewed exuberance and excitement over everyday living. We have so many of these stories and continue to be passionate about homes and what our homes can do for us. We are partners in many of our past clients’ lives because we know how to help them make these transitions. Have you been thinking about something different? Let’s explore together.

Is your current home getting too tight? Do you have a growing family? The average move-uppers purchase a home 1.5 times larger than their current home. For example, they move from a 2,000 to a 3,000 Sq Ft home. When the 3-car garage of our previous home was filled with storage back in 2008, we knew it was time to upsize. Having a larger home now has increased our quality of life in every way. We are happy to have made the move and will be happy to help you too.

Some of us are, or will soon be, empty nesters. Do you have empty rooms or a pool that is never used? Is the maintenance of a large home getting tiresome? Most homeowners downsize to simplify or lower the cost of living. A common theme is to purchase a smaller home outright with the equity from the selling of the current, larger home. Many may also downsize not necessarily to reduce cost, but to increase the quality of life, purchasing smaller homes in more desirable areas or into a newer, more upgraded home. We can introduce new, special communities to you.

If you’ve grown weary of spending your vacations in hotels and rentals, consider joining the nearly one million buyers across the country that purchased a second home last year. This is a dream for many people. After the hustle and bustle of a busy week, imagine a relaxing weekend at the beach or the “lake house” to recharge yourself. Some clients have also shared success stories of renting out their properties part-time.

It has been said that the majority of the wealth in the United States has been made in real estate. There are many facets to real estate investing. We have worked with different investors over the last 18 years, from young couples fixing up one small home at a time, to sophisticated investment groups that purchase dozens of properties. Among our past clients, their various goals have included portfolio diversification, capital preservation, cash flow, and equity building. Two things that can make real estate a truly unique investment vehicle is the amount you can leverage (borrow) and the fact it can generate income. If a home is purchased with a 20% down payment and the rent pays the mortgage, that is an 80% leverage! Also, the fact that real estate can generate rental income sets it apart from most other investments. For most other investments to be profitable, they have to increase in value. Real estate can be a win even if the value doesn’t go up. Tell us about your personal goals. We will see what we can do for you. We have been real estate investors ourselves for many years and we are happy to share with you our experience.

Some of our clients apply the principle above as their retirement plan. They purchase properties whenever possible with the goal that upon the mortgage payoff, the rental income can support or supplement a comfortable retirement. This is exactly what my parents have successfully done. It’s never too early to start! We are already teaching our children the importance of long-term planning.

I’ve given this example in the past. Is there a newborn or a young child in your own or extended family? Consider buying a rental home for the benefit of the child. Let’s say you can do it with 20% down and a 15-year mortgage. When the child is 15 years old, the property will be paid off. It can be sold for college tuition or other financial needs. Or, the future monthly rental income can help cover the child’s expenses. Even with a 30-year mortgage or other configuration, it is a significant head-start for your loved ones. Or, what if your kid is already heading off to college? Many parents have purchased rental properties around UCF for their kids and rent out extra rooms to roommates, which pays the mortgage.

Here is a creative way to look at real estate. In 2014, I was in the market for a new car to replace the 10-year old family minivan. However, a car is a depreciating asset, meaning it’s worth less each day you own it. Whereas, for the most part, real estate is an appreciating asset. So, in 2014 I bought a rental property with a down payment similar to what it would have cost me to buy the new car with cash. This property generated the monthly positive cash flow needed to cover the monthly car payment. So, in the end, I owned the property AND the car!

We sincerely wish you a happy, healthy, and prosperous new year. As always, if you have any real estate related questions, give us a call! We are happy to discuss real estate topics even when it’s not business.

Until next month, take care!

Happy December! It’s that time of the year again where we want to wish you a very happy holiday season. Whatever traditions you celebrate, may they be filled with joy, warmth, and goodwill.

As our team reflects on this past year, we are full of gratitude. We want to thank you for your continued trust and support. Once again , we have helped over 70 families with their home purchases and sales in this year alone. Whether it be upsizing, downsizing, buying a first home, relocating, retiring, or buying or selling an investment property, we are honored to have been a part of the journey. Each and every journey we took with our clients was special and memorable in some way. We are grateful to have been entrusted to be the guides in achieving your real estate goals. We hope our sellers are enjoying the next chapter in their life’s journey, and our buyers are enjoying the wonders of homeownership.

Please feel free to reach out to our team with any real estate related questions. We are passionate about real estate and spend much of our time as a team discussing the market. We will always be here when you need us. If buying or selling real estate is in your near future, give us a call.

We sincerely wish you a truly wondrous holiday season. May you enjoy the fruits of your labor and the warmth of loved ones in the remainder of this year.

Happy November! We hope you are enjoying the sudden drop in temperature today to remind us it is the fall season.

We want to share an article with you this month: UCF Gets $3.4M to Help Buyers Identify Property Risk. We look forward to the completion of this project so we can all have an additional tool to help us make the most informed decision is our home purchase.

The goal is a program that easily outlines a residential property’s disaster risk to help people make more informed buying decisions.

ORLANDO, Florida – When buying a home, people often weigh multiple variables, such as the quality of schools, crime rates, cost and property values. However, they rarely “think about disaster risk, mostly because there is no easy way to do so,” according to a release from the University of Central Florida (UCF).

UCF Professor Chris Emrich and his team hope to change that. The National Academies of Sciences, Engineering and Medicine Gulf Research Program awarded Emrich and his team $3.4 million to help people make smarter housing decisions based on hazard risks and mitigation of those risks.

“To make informed decisions about where to live and how to protect housing investments, residents require knowledge about potential natural-hazard exposure and impacts along with available mitigation strategies,” Emrich says. “This project aims to advance community resilience by improving people’s understanding of risks and their willingness to undertake hazard mitigation when choosing where they live.”

UCF says the idea isn’t to limit where people should live based on potential risk; instead, it’s to give renters and buyers a more complete picture of potential hazards and what it would take to protect a property against those risks, such as hurricanes, sea rise and sink holes.

Information on hazards and risks is already out there, but few homebuyers know where to find it. The UCF team plans to gather the existing information, analyze it and create a rating system or HazardScore for every parcel of land, community, county and state in the gulf region.

The team plans to develop easy-to-use tools for consumers, such as apps, maps and websites, which potential buyers could explore and become more “hazard aware.” The team also hopes to make the tools easy for real estate sites such as Zillow, Realtor.com, Redfin, Trulia and Nextdoor to “plug in” so buyers can get the HazardScore immediately before making a final decision.

The grant money is part of the National Academies of Sciences, Engineering and Medicine’s Gulf Research Program. A total of $10.7 million in grant awards was announced for four new projects focused on enhancing community resilience in the U.S. Gulf of Mexico region. UCF’s award was the largest of the group.

“Based on experiences with events such as a major hurricane or the aftermath of the Deepwater Horizon disaster in 2010, many gulf coast communities have an increased interest in taking actions to enhance their resilience,” says Chris Rea, associate program officer for the Gulf Research Program. “However, they don’t always know where to start. Scientists studying resilience have a growing wealth of knowledge that can help if they can get it to the people that need it. With this grant competition, we set out to help bridge the gap between the science and practice of resilience.”

“We truly believe that if people see a home as the first line of defense and think about the home in terms of safety, they will avoid many losses if a disaster does occur,” Emrich says. “We are attempting to shift the disaster risk/awareness paradigm and help people make smarter housing decisions based on real risk potentials and mitigation of those risks. In doing so, we aim to build both individual and community resilience.” © 2019 Florida Realtors®

Until next month, take care!

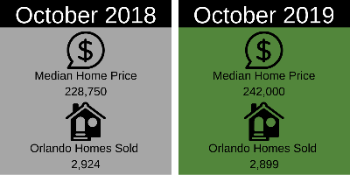

Have you been thinking about buying a home or making a move? This is the perfect season for it. After the fast pace of the peak summer buying season, the real estate market is taking a break. This is seasonally the slowest time of the year for real estate transactions in Central Florida.

This means if you go shopping for a new home now, you will have less competition from other buyers. You are less likely to make a rushed decision. Plus, it’s cooler and dryer out now, so it will be more pleasant to go house hunting with us!

Once you find the home of your dreams, we will help you negotiate a contract on it. It typically takes 30 days for a home loan to get approved, so you can expect a 35-45 day closing from the time of contract.

Imagine, if you achieve contract to buy a home NOW, you can spend Thanksgiving in your new home! If you achieve contract at the end of October or early November, you can spend the holiday season in this new home and start 2020 with a new beginning!

What a way to finish 2019 in a new home! It can be your very first home or the latest of several homes. It is equally exciting. We live vicariously through our clients and share this excitement every time it happens. We hope to share it with you soon!

Many of our past clients met with us before making their real estate decisions. We want to emphasize that we LOVE brainstorming with you. Our objective is not to convince you to buy or sell. Our approach is to provide you the information you need, so you can make the best decision for yourself, whatever that may be. We invite you to contact us and share your real estate dreams and goals with us. We will do everything we can to provide you the best information and assistance.

Enjoy the magical month of October! We hope to see you soon. Until next month, take care!

Happy September! We hope everyone stayed safe from Hurricane Dorian. We are thankful to have been only minimally impacted in Central Florida. Our thoughts are with those that have suffered and those that are still in its direct path.

As we enter the fall season this month, we also officially enter the “slow” season for Central Florida real estate. If you are still in the market to buy or sell a home, give us a call without delay! We will provide timely insights that you may find helpful.

We have continued to receive questions from homeowners about companies (collectively called iBuyers) that offer to buy their home with cash. We wrote about this topic last year. We will repost it below, plus we will share the findings of a new study that was published in August this year that validates our prior assessment. Dr. Michael Sklarz and Dr. Norman Miller with Collateral Analytics published “iBuyers: A new choice for home sellers but at what cost?”.

Overall, the study found that iBuyers cost homeowners 13-15% of their home’s value. The authors concluded that sellers that sold to these companies “are paying not just the difference in fees of 2% to 5% more than with traditional agencies, and a generous repair allowance, but another 3% to 5% or more to compensate the iBuyer for liquidity risks and carrying costs. In all, the typical cost to a seller appears to be in the range of 13% to 15%”

A: These companies are “flippers”. They are not looking to buy homes to hold in their rental property portfolio like investment companies in the 2010-2013 era. They are buying homes directly from homeowners at a discount, then putting the homes right back on the market to sell at a profit.

The typical offer sounds enticing, but they also charge full commission and other selling costs, plus significant additional fees to use their service. Their angle is an easy transaction, as-is, cash, and flexible closing date. But they are not in the business to lose money. They will inspect the home carefully, and you can be assured they will demand compensation if problems are found.

Make no mistake, iBuyers are not in the business to provide a public service. They are in the business to make a profit. Since they are simply “flipping” your home (put your home right back on the market with minimum additional investment), in order for them to make money, you CANNOT make money.

They have to acquire your home below market value. They also make up the profit margin by charging all customary selling costs, full commission, plus additional fees. Do not believe they are paying fair market value. That is not possible. They have to sell it again soon, and for a profit. Once you understand they are “flipping”, it is easy to understand how this works.

There is nothing wrong with this business model. We all know if we sell our cars to an auto dealer, they will resell it at a higher price for a profit. This is perfectly normal. We are trading top dollar for convenience.

However, unlike a car, our homes are likely our largest assets. It can take many years to build up equity. Is a quick, convenient sale really worth giving up a 5-figure value in your home? That is tens of thousands of dollars that should be in your bank account.

We are real estate professionals whose sole mission is to guide homeowners through the process of home-selling to achieve the highest price possible, with the maximum profit going to the homeowners. We always work closely with the sellers to prepare the home for sale for the most gain, then we take over the marketing and selling and make the process as smooth as possible for the sellers. Our track record speaks for itself.

If you are thinking about selling a home, let us walk you through the process and show you how you can get the most money for your home!

Until next month, take care!

– Yien and The Yao Team