Happy September! We hope you had a great Labor Day weekend, and will enjoy the remainder of the summer as we look forward to the transition into autumn later this month.

This month, we’ll talk about the background history and practical use of the seller disclosure statement. The seller disclosure statement is common in residential real estate transactions and often taken for granted. However, it did not exist before 1985. Prior to that, buying a house was like buying a second-hand car, in that the seller didn’t always tell the buyer if there were hidden defects.

Q: What is the seller disclosure statement? Must I fill one out before I can sell my home?

In the landmark 1985 legal case (Johnson v. Davis, 480 So.2d 625, Fla. 1985), the Florida Supreme Court ruling changed the long-held tradition of “caveat emptor” or “buyer beware” when it comes to residential real estate transactions.

The Davises (buyer) had signed a purchase contract with the Johnsons (seller) to buy their house. The Davises had asked about some plaster damage around a window frame and some stains on the ceilings in a couple of rooms they noticed. The Johnsons replied that the window had a “minor problem that had long since been corrected”, and that the ceiling stains were wallpaper glue. They assured the Davises that there was “no problem with the roof”.

Later in the transaction but before closing, in the wake of heavy rainfall, the Davises discovered significant roof leaks that would require a roof replacement.

The Davises subsequently sued the Johnsons, alleging that the house had a defective roof which the Johnsons failed to disclose. The Florida Supreme Court’s ultimate ruling in favor of the Davises established a new standard that the seller of a home has a duty to disclose to the buyer all known facts that materially affect the value of the property that are not readily observable or known by the buyer.

The law doesn’t actually require this disclosure to be in writing. However, putting things in writing is the best way to document what’s said. Florida Association of Realtors created a Seller’s Property Disclosure form to help sellers comply with the disclosure requirement. I’ve seen different versions of the seller disclosure created by different companies. They are all intended to help with the process, while none is a “required” standard form.

When we help homeowners prepare for the home selling process, we give them a blank copy of the disclosure form. This form is in a question-and-answer format, intended to help the sellers to follow and think in an organized manner. Otherwise, it’s not easy to remember everything, especially if they have owned the home for a long time. It’s best to think of this form as “a way to come clean” on past history and potential issues of the home. Once the sellers disclose something, and the buyers acknowledge and sign off on it, the buyers are not likely to call after closing. Otherwise, “failure to disclose” is an unfortunate reason that sometimes comes back to haunt the sellers after a successful closing. Remember “when in doubt, disclose, disclose, disclose!” If a seller does not know something, it’s perfectly okay to answer “Don’t Know”. Sellers are only responsible to the extent of their knowledge and awareness.

Some examples of clear and concise statements are below. Although, they do not have to be short. I’ve seen sellers attach extra pages and wrote in paragraph form.

“Roof leaked around the chimney in 2015, repaired by roofer, no problem since”

“Termites were found in the guest bedroom in 2014. Treated by Terminix with full termite bond and no problem since. The termite bond is transferrable to new owners”

We have managed many transactions where the home had significant negative past issues, such as flooding, water damage, and mold. When buyers have the proper disclosure, combined with their home inspection to assess the current home condition, they can make educated decisions. It is ill-advised to attempt to hide problems and force a sale. The important thing for the sellers is to have the peace of mind that they’ve sold their home properly. The important thing for the buyers is to have the information so they can make the most informed decision about their purchase.

For buyers, we advise that it’s crucial to understand the seller disclosure is not a guaranty or warranty of any kind. It is not a substitute for any inspections, warranties, or professional advice. It is also not a substitute for buyers’ own judgment and common sense. The information is based only upon the sellers’ actual knowledge and they may not know about all material or significant items or hidden defects. A professional home inspection is a must. The original Johnson vs. Davis case may not have occurred if the Davises simply had a professional home inspection. From what I remember, it was a for-sale-by-owner situation where neither party was represented by a real estate professional. We real estate professionals are well versed in the details and nuances of a transaction. Even though real estate agents are not required in a transaction, we do help transactions progress properly and as smoothly as possible, for both parties.

We will stop here. Please send in your own real estate related questions. Let us know how we can help. Also let us know who we can help. We love referrals!

Happy August! In the blink of an eye, the summer break is almost over. Kids are getting ready to go back to school. Usually with the coming of August, our local real estate market activity begins to cool a bit. This is seasonal and expected. Most sellers and buyers complete their relocation during the summer time. However, we have always been busy throughout the whole year and we work with buyers and sellers in all seasons. In fact, several new listings are coming in August. Stay tuned!

This month, I will discuss home improvements in the context of helping home sales.

Q: I know we will be selling our home in a few years. We would like to make improvements that we can enjoy now but would also help sell the home when the time comes. Can you give us some pointers?

A: Certainly! This is a common question. One of the joys of homeownership is the ability to make changes to the home to reflect your taste and style. Home improvement TV shows are extremely popular for this reason. First principle to keep in mind is that, most home improvements do not recover dollar for dollar. The prime example is the additional of a swimming pool. A $40,000 pool may only bring $20,000 in resale or appraisal value. On the other hand, granite, or other premium countertops, may be an exception. Often the value added is not merely how much more the granite countertops is worth, but that such improvements raise the home to another category of comparables. For example, often in an older neighborhood, homes with original features sell for one price range, while homes with renovations sell for a higher range. The granite countertops can move a home from the first category into the second category and justify a higher price. This can be complicated and depends on the nature of the comps in a neighborhood. Ask us for a customized analysis! The following are some major categories of home improvement.

If you would like a personalized recommendation, just give us a call! It’s never too early to plan ahead.

We will stop here. Give us a call if you have any real estate related questions, or know of someone we can help! We love referrals!

Until next month, take care!

Yien and the Yao Team.

Happy July! We hope you had a terrific Independence Day. It is officially the summer season. We hope you are having a good summer so far. Our housing market is robust. I received several questions about house-flipping. I will share with you the basic concepts of housing flipping in this month’s “House Flipping 101”.

Q: How does house flipping work? What do I need to get started?

A: There are different types of house flipping. In this article, I’ll focus on the standard model of buying a fix-upper property, renovate it, and then resale it for a profit. I’ve worked extensively in Orlando area with house flippers in the past. I will share the basic concepts below.

1. Money: The best opportunities in flipping homes for profit lie in the true fix-uppers. These properties are not going to pass inspection and secure financing from banks. So, flippers need to have cash to buy the property. Then they need additional cash to renovate the home. Only when the home is finally resold, do they get their cash investment back (plus profit).

· Own money: Many flippers use their own money. I’ve worked with flippers that use an equity line of credit on their home to fund their house-flipping ventures. I’ve seen a few partners pooling their limited funds into a workable sum.

· Other people’s money: Some flippers borrow money. These are short-term, high-interest “hard money” loans. An example is 15% interest for a 6-month loan. This allows 3 months for renovation, and 3 months for marketing and selling of the home.

2. Acquisition of property: Finding the right property, and buying it at the right price, is a critical part of the whole process. The expertise and comfort level of the flipper will dictate the extent and scope of the repairs and renovation that should be undertaken.

· Fix-upper properties can be found on the MLS, foreclosure auctions, and door-knocking to find prospective sellers. I’ve worked with investors exclusively through properties listed in the MLS. These listed properties have clear, marketable titles. Other investors groups may participate in auctions and direct solicitation. The caveat of acquiring properties through auctions is to be careful of properties without clear title. A certificate of title does not mean you have clear title.

· Inspection is critical. This is where the house-flippers map out the extent and scope of work required to realize the vision of the renovated home. The estimate of cost will dictate how much one can pay for the property. The inspection should also include a permit search. I’ve seen properties that were built without proper permits. The buyer of a property essentially inherits all the problems of the property.

3. Renovation: Some consider this the fun part. Some flippers do the work themselves, while others subcontract out various projects. One must make sure the work is done properly, and with necessary permits. Otherwise, the Florida disclosure laws and buyer inspections may make resale challenging.

4. Resale: When the property renovation is complete it is ready to be listed on the market. I’m often impressed when I first see the “after” look of the prior fix-uppers. Usually in the latest style and colors, outfitted with the latest fixtures, these renovated homes can be a pleasure to behold. I had fun listing them, and I saw the excitement of buyers who would be living in them.

For a house-flipping project to be profitable, you need to execute many steps correctly. You can’t overpay for a property. You can’t miss problems with the property or underestimate the cost of repair. You must manage the renovation budget and timeline tightly. Lastly, you need to market and price the finished home properly in order to sell it at the highest price in the shortest time. Hopefully, after paying all expenses (and don’t forget taxes), you will have a nice profit!

In the hot housing market of the last several years, the challenge has not been with selling the finished the home. The challenge has been finding the right properties, at the right price. Much of the competition is among house-flipping groups themselves. In auctions and open market, they bid against one another for the properties. The well-run groups with proper knowhow, good discipline and management, can make a project profitable whereas a less experienced group might lose money.

This is just a basic description of the house-flipping process. If you want to find out more, we are available for consultations.

As always, if you are planning on buying or selling a home in 2018 (or even 2019), it’s never too early to have a conversation with us. Many of our clients today started planning with us last year!

Give us a call if you have questions, or know of someone we can help!

Until next month, take care!

Yien and the Yao Team.

Happy June! The kids are out of school now and the summer season officially starts on June 21st. The rainy season is upon us. It’s a good idea to have your roof checked if you haven’t done so since hurricane Irma. We’ve had a lot of rain. Many times, a homeowner’s discovery of water intrusion is a little too late. Remember to lower the water level in your pool if you plan to be away for a week. You may also want to consider turning off the lawn irrigation system, especially if you do not have a rain sensor. I usually turn off mine between May and September.

Once again, we continue to see a lot of relocation homebuyers this year. This continues the trend of the recent years. It’s not a surprise because Orlando is one of the nation’s fastest growing job markets. This bodes well for a strong local economy and extends the strength into our housing market.

The demand for housing remains strong. The current average Orlando home sale price is $286,300 and median price is $237,000. The inventory level is stable this year, but we saw some price bumps. Low appraisals are more common (I wrote about this last month) as a reflection of uneven price increases. Homes priced too high often see price reduction(s). These suggest mature market forces. We do not have a run-away market where the buyers are willing to pay any price for a home and banks are willing to make any loan (like in 2004-2006). The check-and-balances appear to be functioning properly.

Now, the weather. Starting with June, we officially enter the 2018 Atlantic hurricane season. It lasts through the end of November. The current projections point to an average to slightly-above-average season.

It’s easy to get complacent in central Florida because hurricane crossing is a rarity. Hurricane Irma’s from last year is a reminder we should always be prepared. A slight change of course can put us right in the path of a storm.

It’s a good idea to make sure you have a supply of nonperishable food and water to last 3-7 days, as well as supply to deal with loss of power for the same duration. The Florida Legislature approved a “disaster preparedness” sales tax holiday June 1 through June 7, to encourage the public to be proactive in preparedness

As homeowners, you should also check and make sure your property insurance is adequate. Understand the difference between the regular deductible, and the separate deductible for hurricane damages, which are generally based on a percentage of the home’s insured value rather than a flat dollar amount. For example, you can have a $1,000 deductible for regular damage claims, but a separate 2% deductible for hurricane damages. If your home is insured for $350,000, then 2% of that is $7,000. That means if a storm causes damages, you will be responsible for the first $7,000 of repairs!

The hurricane deductible usually goes into effect only when a storm is categorized as a hurricane by the National Weather Service. In some policies, it kicks in when a storm is named, even if it doesn’t become a hurricane.

Last year I shared this document. Here it is again. The Florida Department of Financial Services offers a hurricane financial prep toolkit in PDF form. It has an insurance checklist that includes adjuster contacts and emergency service contacts, such as the Red Cross, FEMA and the Department’s consumer helpline, as well as a log of calls made to insurance companies about claims.

Once prepared, I hope we do not see a hurricane making landfall this year!

As always, if you are planning on buying or selling a home in 2018 (or even 2019), it’s never too early to have a conversation with us. Many of our clients today started planning with us last year!

Give us a call if you have questions, or know of someone we can help!

Until next month, take care!

Yien and the Yao Team.

Happy May! We hope this email finds you well. The Orlando housing market is in its peak spring/summer season. This year, we are seeing more incidences of home appraisals coming in below contract price. This month, we will revisit the home sale and appraisal process.

Q: My neighbor’s house got multiple offers. I heard that after it went under contract, the appraisal came back low. Can you help me understand what’s going on?

A: Certainly. Your question contains multiple reflections on the current Orlando housing market. To understand the whole process I’ll explain each one.

1. The first is that of the housing inventory shortage. Multiple factors contributed to the low inventory level. I have written about the root cause of the shortage of entry-level homes (March 2017). But we also have a shortage of mid-range homes. Many homeowners are happy with the appreciation they see in their current home, but have difficulty finding the ideal next home both in terms of right price and good selection. They end up staying and renovate their homes instead. This has resulted in a boom in the home-renovation industry, and exacerbated the inventory problem (fewer sellers = fewer listings).

If a home is in the right condition and has the right listing price, there is a good chance of multiple buyers wanting it. This results in a “multiple-offers situation” where the buyers make their highest and best offer to bid on the home. The price is not always the only determining factor. Other terms such as financing, inspection, contingencies, and closing date come into play too. The listing agent helps the sellers sort through the offers to select the best one that best meets the sellers’ needs.

When a buyer is particularly motivated, he or she might be willing to pay a premium to buy a home. This premium may mean different things. It may be a full price offer, above-asking offer, or simply a reasonable offer based on comps, regardless of the listing price (buyers have access to valuations tools and are more educated about price than ever before).

2. Market value of a home, to put it simply, is the price it brings in a competitive and open market under all conditions requisite to a fair sale. Today’s market is healthy, distressed properties such as bank-owned and short sales are rare. Under most circumstances, a typical residential contract is negotiated under fair conditions. We can argue the resulting contract prices therefore reflect market value.

3. When a buyer is purchasing the home with cash, a price is negotiated, and the transaction closes at that price. That is the end of the story. However, most buyers purchase homes with a mortgage loan. When the bank is involved, a professional appraisal is required. This is the way the bank assesses its risk related to the property value. Even though appraisal value is used as market value, I’ve coined the term “collateral value” to help people better understand the relationship. When a buyer borrows money from a bank to purchase a home, the home is pledged as collateral for the debt. An appraisal is hired by the bank to make sure the house value is adequate to cover the debt in case of foreclosure. The appraiser has liability for his work. When a market is heated or when a home is particularly improved and upgraded, I often see an unwillingness on the part of the appraiser to be “wowed”. Many appraisal reports are strict and do not give value to “wow” factors. This is the job of the appraisers. They can provide an effective brake so prices don’t run wild like the last real estate bubble. But this also causes much frustration to all parties involved in a transaction because the bank will not make a loan above the collateral value.

4. So, what happens when an appraisal comes back low? The agents can challenge the appraisal with additional information. The buyer and seller can renegotiate the purchase price. If no new agreement is reached, the contract may be cancelled, and the home goes back on the market for another try.

Throughout this whole process, an experienced agent can really make a difference. We have many stories to share. If you are thinking about buying or selling a home, talk to us first before you make a move. We have seen all seasons of a real estate cycle.

I will stop here. Until next month, take care!

Yien and The Yao Team.

Happy April! I hope you have had a wonderful first quarter of 2018.

If you have been in your home for a number of years and have significant equity in that home, you may have received advertisements from a new wave of companies offering to purchase your home with cash. I have received many questions from homeowners about these companies’ offers to buy their homes.

Q: I have received ads from online companies offering to buy my home at competitive price and no hassles. Is it for real? Is it worth it? How does it work?

A: These companies are “flippers”. They are not looking to buy homes to hold in their rental property portfolio like investment companies in the 2010-2013 era. They are buying homes directly from homeowners at a discount, then putting the homes right back on the market to sell at a profit.

The typical offer sounds enticing, but they also charge full commission and other selling costs, plus significant additional fees to use their service. Their angle is an easy transaction, as-is, cash, and flexible closing date. But they are not in the business to lose money. They will inspect the home carefully, and you can be assured they will demand compensation if problems are found.

Make no mistake, they are not in the business to provide a public service. They are in the business to make a profit. Since they are simply “flipping” your home (put your home right back on the market with minimum additional investment), in order for them to make money, you CANNOT make money.

They have to acquire your home below market value. They also make up the profit margin by charging all customary selling costs, full commission, plus additional fees. Do not believe they are paying fair market value. That is not possible. They have to sell it again soon, and for a profit. Once you understand they are “flipping”, it is easy to understand how this works.

There is nothing wrong with this business model. We all know if we sell our cars to an auto dealer, they will resell it at a higher price for a profit. This is perfectly normal. We are trading top dollar for convenience.

However, unlike a car, our homes are likely our largest assets. It can take many years to build up equity. Is a quick, convenient sale really worth giving up a 5-figure value in your home? That is tens of thousands of dollars that should be in your bank account.

We are real estate professionals whose sole mission is to guide homeowners through the process of home-selling to achieve the highest price possible, with the maximum profit going to the homeowners. We always work closely with the sellers to prepare the home for sale for the most gain, then we take over the marketing and selling and make the process as smooth as possible for the sellers. Our track record speaks for itself.

If you are thinking about selling a home, let us walk you through the process and show you how you can get the most money for your home!

~Yien and the Yao Team

Happy March!

The Florida Realtors Association recently published 2017 Profile of Home Buyers and Sellers Florida Report, as well as the 2017 Profile of International RE Activity in Florida Report. In reviewing these reports, we want to share with you some interesting highlights and insights (all credits to FAR and NAR).

Florida Buyers:

Florida Sellers:

Florida residential property purchases by foreign buyers

If your dreams and goals this new year involve real estate, we are always ready to assist. Feel free to reach out to us. We enjoy brainstorming with our customers. Take advantage of our market experiences, which are often different than what you read and hear in the national news, and always more relevant at a local level.

We at the Yao Team are fervent believers of the benefits of homeownership and real estate investments. We love real estate not just professionally but also personally. We hope you will consider us as your consultants and your advocates when it’s time for you to buy or sell a home.

Until next month, take care!

Yien and The Yao Team

Happy February! We hope 2018 is off to a great start for you.

It’s that time of year again. The application deadline for filing the Florida Homestead Exemption is fast approaching on March 1, 2018.

If you moved to a new home last year and haven’t done so already, please remember to apply for the Florida Homestead property tax exemption before the deadline of March 1, 2018. There are numerous financial benefits to having this exemption, including a saving of up to $750 annually on property taxes!

Florida residents who own and live in their permanent residence can apply for this exemption. You must live in the home as of January 1st of this year.

Another major benefit of the Homestead Exemption is that the assessed value of your home, which is used to calculate your property taxes, cannot increase more than 3% per year, pursuant to the Save Our Homes Amendment to the Florida Constitution. This prevents large increases in property taxes with market fluctuation that can be devastating for homeowners on a fixed-income.

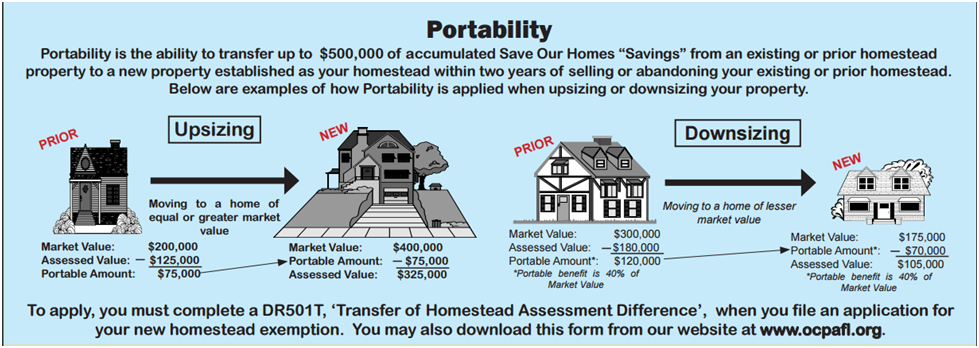

After a homeowner has lived in a home for many years, the assessed value “savings” can accumulate to a significant amount. In the past, this accumulated savings used to be lost when a homeowner sold their home and moved to a new one. This resulted in some homeowners effectively become “trapped” and couldn’t afford to move because the new home had a much heavier tax burden. Fortunately, Florida passed the law that allowed “Portability”, where we can now transfer up to $500,000 of accumulated “savings” from a previous homestead to a new one. The diagram below explains this.

You should definitely take advantage of this law. Be sure to apply if you haven’t done so already.

Once you receive the Homestead Exemption, it is automatically renewed each year. You do not have to re-file again, until you move.

You can file the application online, by mail, or in person. We have included links for the 5 counties in Central Florida at the bottom for your convenience.

You will need to provide the following documentations:

Orange County

Main homestead page http://www.ocpafl.org/Exemptions/hx_file.aspx

Online Form https://exemption.ocpafl.org/

Satellite offices http://www.ocpafl.org/satelliteoffices.aspx

Seminole County

http://www.scpafl.org/ExemptionInformation

Osceola County

https://ira.property-appraiser.org/homestead/WebForm1.aspx

Lake County

https://www.lakecopropappr.com/exemptions.aspx#homestead

Polk County

Okay I will stop here. We sincerely wish you a happy, healthy, and prosperous new year. As always, if you have any real estate related questions, give us a call! We are happy to discuss real estate topics even when it’s not business.

Also, we love referrals!

Until next month, take care!

-Yien & The Yao Team

Happy New Year! We hope you have gained wisdom through your experiences in 2017. We wish for you the full optimism, energy, and momentum that comes with the start of a new year. We are excited and hope we can all aim to do better, live better, and be better this year!

If your dreams and goals this new year involve real estate, we are always ready to assist. Feel free to reach out to us. We enjoy brainstorming with our customers. Take advantage of our market experiences, which are often different than what you read and hear in the national news, and always more relevant at a local level.

So, what’s ahead this new year in our Orlando real estate market?

We at the Yao Team are fervent believers of the benefits of homeownership and real estate investments. We love real estate not just professionally but also personally. We hope you will consider us as your consultants and your advocates when it’s time for you to buy or sell a home.

Happy New Year!

Yien and The Yao Team

Happy December! It’s that time of the year again. We want to wish you a very happy holiday season. May it be filled with joy, warmth, and goodwill.

We want to thank you for your trust and support this year. We helped 70 families with their home purchases and sales this year. In 2017, many of our clients have upsized, downsized, bought a first home, relocated, bought an investment property, or sold an investment property. Whatever the purpose and reason, we are honored to have been a part of the journey. Each and every journey we took with clients was special and memorable in some way. We believe in home ownership and real estate investment. We are grateful to have been entrusted to be the guides in achieving your real estate goals.

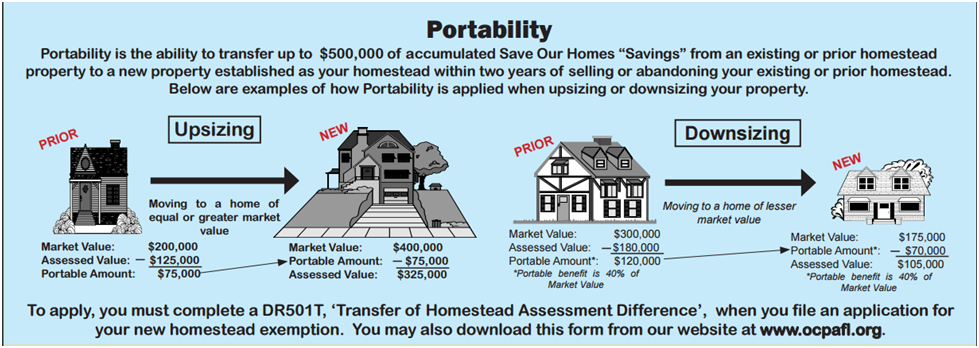

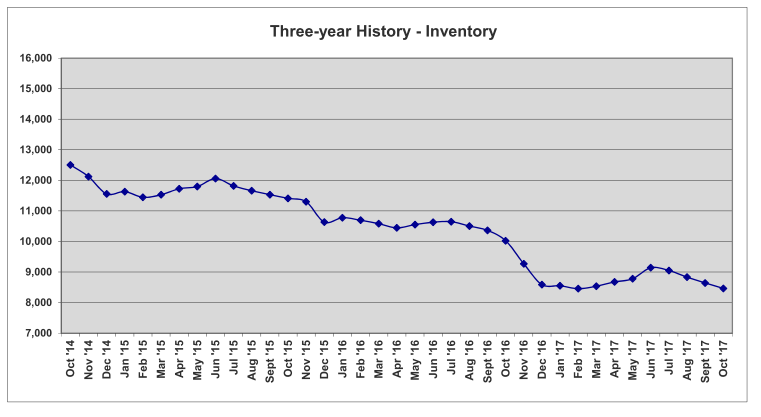

Looking back in 2017, Orlando continued to enjoy a healthy, stable, and mature real estate market. As I have said throughout the year, the market behavior depends on the price segment, and of course, the location. The October median price of a home in Orlando is $218,000 (vs. $205,000 a year ago). The average price is $259,600 (vs. $247,200 a year ago). Homes doubling this price point move slower but homes below this mid-$200’s average price are in short supply. New constructions do not alleviate this shortage because it’s difficult for today’s builders to bring the cost down low enough to be in that market segment. So the pressure and challenge continue for first time home buyers and entry-level home buyers.

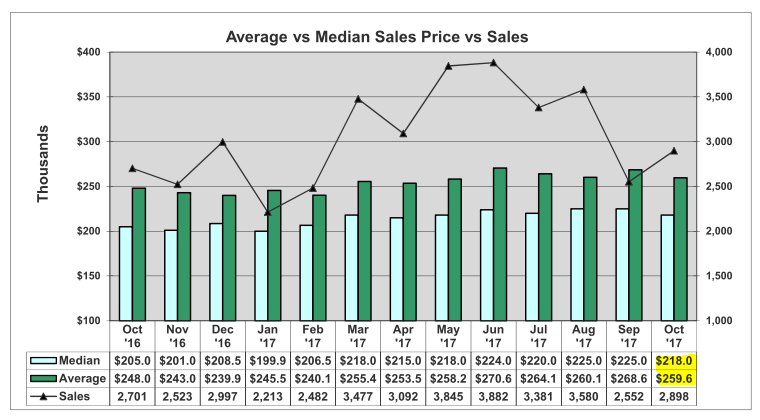

The inventory of homes for sale remains near a record low. As of October, the latest housing data we have, the number of residential properties for sale through the Orlando Reginal Realtor Associationis 8,464.

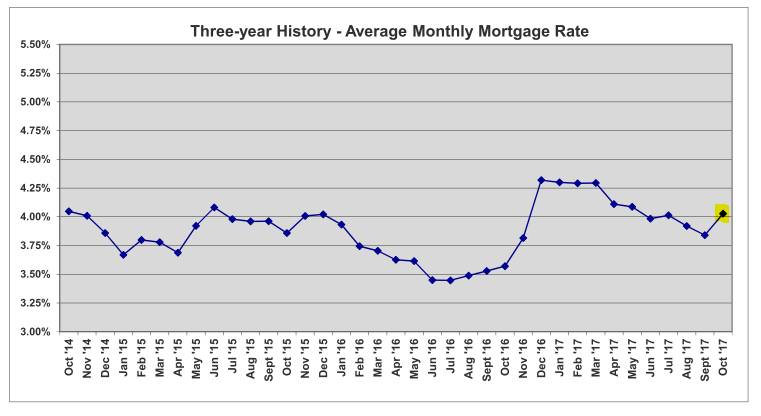

Those that bought a home in 2016 will probably enjoy the lowest mortgage interest rates that we will see in some time. We have spent most of 2017 at a mortgage interest rate above 4% for a 30-year loan. The market has adjusted to that. Interest rate will continue to be an important factor to shape the 2018 market.

On the positive side, 4-5% is still an incredibly low interest rate. Those of us that have been around a while can certainly remember much higher rates. We are used to this prolonged low interest rate environment but we will no doubt “survive” as rates rise higher.

Stay tuned for the January 2018 Orlando Real Estate Journal. We will share with you some market projections for the coming year!

We’ll stop here. We sincerely wish you a truly wondrous holiday season. May you enjoy the fruits of your labor and the warmth of loved ones in the remainder of this year.

Yien and The Yao Team.