Happy June! We are near the half-way point of the year. The rainy season in Orlando is coming and the summer is certainly upon us. We hope you will have a fantastic month of June.

We will continue from the last 2 months and conclude the 3-part discussion on real estate appraisals. Next month, we will provide a 2015 year-to-date summary of the Orlando housing market!

PART III

Last month I discussed the convergence as well as divergence of approach and valuation opinion of real estate agents and appraisers. As I said, in majority of cases the mortgage appraisal supports the purchase price. So what happens if an appraisal comes back lower than the purchase price? For example, a buyer and seller agreed on a purchase price of $300,000 and the mortgage appraisal comes back valuing the home at only $290,000. When this happens, the transaction can be in jeopardy. The standard real estate contracts in Florida (FR/BAR-3 and CRSP-13) both contain appraisal condition within the financing contingency. The provisions differ in detail, but generally if the appraisal is insufficient to meet the loan requirement, the contract can be cancelled. To salvage the deal, we first request a copy of the appraisal and review it for simple mistakes. For example, I have seen an adjustment value that’s supposed to be a plus entered as a minus, thus resulting in 200% deviation. That can be corrected, but if there are no simple mistakes, it’s very difficult to contest an appraisal in recent years. Many have tried, few have succeeded. So the next step is typically renegotiation between buyer and seller. Based on circumstances and the perceived quality of the appraisal, sometimes the seller will reduce the purchase price to the appraisal value. Other times, the buyer will pay above appraisal value. Most commonly, the buyer and seller bridge the difference together. When no agreement is reached, the contract can be cancelled and the deal dies.

Can an appraisal also be too high? Yes, but in mortgage process this is not a problem. The bank is happy to make the loan. It does create a problem, when an appraisal done to determine asking price of a home is too high.

I have quite a few experiences responding to calls from sellers who obtained appraisals first, and then found frustrating lack of success in the market place in trying to achieve the projected price. When I review these price-setting appraisals, I can always find the assumptions that led to unrealistic results.

As I discussed last month, the bank scrutinizes mortgage appraisals. When an appraisal is directly performed for a Seller, there is no such scrutiny. I’ve seen value comparison derived from sales of higher-end homes, higher-end builder, and/or in higher-end communities. I’ve seen generalized equating of different features. For example, both homes are pool homes and assigned equal value, yet the pools are of vastly different quality and appeal. The result: valuation is supported on paper, but not in the open market in the real world.

I hope you now have a more balanced understanding of home valuation. Know there is a difference between “market value” and “collateral value” in a mortgage appraisal when you are buying a home. Also know there is difference between “appraisable value” and “achievable value” when you are selling a home. When you are in the market to buy or sell a home, there is no substitute for an experienced agent as your consultant.

Enjoy your summer. Until next month, take care!

Happy May! Hope you are enjoying the remaining days of Spring.

We will continue on the topic of real estate appraisals from last month:

PART II

When a real estate agent performs home valuations, there are usually 2 different scenarios: (1) Buyer CMA. This is when a buyer sees a home and wants to know if the listing price is low, fair, or too high. A Buyer’s Agent will look at what similar homes have sold for in the neighborhood to answer that question. (2) A seller wants to know what his home will sell for. That, I believe, is the most difficult and skill-based of all home valuations, because it is a forward looking statement. It is essentially a forecast, a prediction. It’s a “crystal ball” expectation. A stock analyst can tell you how a stock has performed in the past. But to predict how a stock will perform in the future is clearly the more difficult task. To predict what a home will fetch in any given market combines “art and science”. It contains both objective components and subjective assumptions. The experience and skill of the agent and the quality and accuracy of that prediction is a factor that contributes to a home that sells fast and high, or lingers on the market for months or even years and eventually expires or sells for lower than market price.

I have high respect for appraisers. Their training and expertise related to home valuations is vastly superior to an average agent. Our function and approach differ in that:

(1) When I perform home valuations, my customer is the seller. My objective is determining the “market price” of a particular home. By “market price”, I mean the price a home can achieve in an open market, in an arms-length transaction. This incorporates an intimate understanding of buyer behavior as well.

(2) In a mortgage appraisal, the appraiser’s customer is the bank. He determines “collateral value” of a home based on a complex list of ever changing rules set by the lending industry. A mortgage appraisal is reviewed and scrutinized by underwriters before it’s accepted by the bank. Rules and guidelines are strictly followed. An underwriter often challenges an appraisal report and the appraiser has to justify and defend his work.

In the majority of cases, my work and that of an appraiser concur. I list a home at my projected market price, we achieve contract at or near that price, and the subsequent appraisal supports the value. Transaction closes smoothly and successfully.

However, sometimes the appraisal comes back below the contract price. The reasons are case-by-case, but based on what I wrote in 1 and 2 above, there are simply divergent viewpoints that are hard to reconcile. For example, would you pay more for a home that has a brand new roof and A/C system, so you wouldn’t have to worry about them in the next 15 years? Would you pay more for a home whose kitchen is equipped with gorgeous top-of-the-line Viking or Thermador appliances? I know I would. Those things have value to me as a buyer. However, you will not see them in an appraisal. Why not? The bank rules say so. In the next issue, I will talk about what happens when appraisals come back low. Also, I will discuss how appraisals can sometimes be higher than market value!

Until then, take care! See you next month!

Happy April everyone! We have just returned from a great Spring Break. Hope you had a wonderful March as well. The market continues its brisk pace and keeping us busy! Let us know if you have any real estate questions. Many of you have asked me about real estate appraisals. I will use the next few months to discuss this broad topic.

PART I.

Most people encounter an appraisal in 3 situations: (1) buying or selling a home when a mortgage loan is involved. (2) refinancing a mortgage. (3) some order an appraisal to help determine asking price of their homes.

First, what is an appraisal? Most people believe an appraisal to be an objective determination of value, but I think it is more accurate to consider it a subjective opinion of value. A licensed appraiser’s opinion of value is called an appraisal. The opinion of a real estate agent is called a CMA (Comparative Market Analysis) or a BPO (Broker’s Pricing Opinion).

A licensed appraiser is a trained professional in rendering that opinion of value. The purpose of this opinion is to help banks make risk assessment in mortgage loan decisions. It is important to understand this: an appraiser’s true customer is the lender financing the purchase, not the buyer or seller. The bank wants to know, if a property is worth at least the sale price. Yes, the appraiser does get a copy of the contract and knows the sale price ahead of time. He is not being asked to make a blind appraisal. If the appraiser agrees with the sale price, the bank will accept the property as the collateral for the loan. The bank does not care if the home is worth more, but it must not be worth less. Many people ask us if the appraisal only has to match the loan amount. But actually, if a bank is lending 80% of value and requiring the buyer to put down 20%, the collateral must meet the 100%, not just the 80%, hence the appraisal value must be at least the full sale price.

As mentioned above, an appraisal is a “subjective opinion of value”. I see the reality of that all the time. I’ve seen different appraisals on the same house come back at significantly different values. I’ve reviewed many appraisals over the hundreds of transactions I’ve been a part of. Most of them are good appraisals, but many can be not-so-good ones. I have good relationship with many appraisers. They contact me routinely to seek additional information on my sales to be used as comps in their reports. I respect the work of professional appraisers but I also distinctively see the difference in what they do vs. what I do as a real estate agent. Our opinions of value can converge or diverge.

Next month, I will discuss this convergence and divergence.

Until then, take care! See you next month!

The Orlando real estate market is approaching full swing. Lots of buyers and sellers are active in the market place now. One of the most popular topics among our neighbors is property pricing and appraisal values. This month I’ll re-share my writing about home valuation. Next month I’ll write about the truths and myths about appraisals.

There are generally 3 approaches to value theory in real estate: (1) comparable sales (2) reproduction cost (3) income potential. In residential resale, comparable sales approach is the method of choice. It uses closed sales to determine the market value of a property. Assuming the market is efficient and the buyers and sellers act in their own best interest, we can derive value based on how sellers are selling and buyers are buying. Like stock prices, the supply and demand ultimately drive the fluctuation in price: when demand exceeds supply, the price goes up. When supply exceeds demand, the price goes down. A home does not have a fixed value. Its value changes with time.

Unlike shares of a company’s stock, no two pieces of real estate are exactly alike. Comparable sales approach takes the available sales that meet the right criteria (sufficiently similar to the subject property, sufficiently close to the subject property, and sale date close enough to reflect the current market) and compare them to the subject property. Adjustments are then made based on established guidelines as well as subjective judgments based on experience to increase or decrease the value. For example, if a home that backs up to a road sold at a particular price, an otherwise identical home across the street that backs up to a wooded conservation would be presumed to be able to fetch a higher price (the value adjustment for conservation frontage). A common feature in Florida homes is the swimming pool. We presume a home with a pool sells for a higher price than an identical home without the pool.

Two crucial factors in doing the comparable sales method correctly are: (1) Selection of appropriate comparable. If wrong comparables are used, however diligent the subsequent adjustments may be, the results will likely be off. For example, Stoneybrook sales should be used for comparables to a Stoneybrook subject property, not Eastwood or Avalon Park. (2) Use right adjustment values. Even when the right comparables are selected, if the adjustment values are improper, the result will be off. For example, once comparables similar in size are selected, the adjustment for difference in square footage is not the average price per square foot. It may only be $30-$60 per square foot based on price range of home.

Licensed appraisers are trained to do this based on their professional guidelines. These guidelines are adhered to in order for the appraisal report to be acceptable by the bank which uses this report to assess its risk in making the loan on the property.

Real estate agents are not licensed appraisers. Their approach should start in the same objective manner as an appraiser, but there are many additional factors to consider. Many features in a home have different values to a buyer than to an appraiser. For example, top-of-the-line appliances in a kitchen will certainly impress a potential buyer, who may be inclined to pay more for this home than a similar one without them, but an appraiser will not appraise the home higher because of the better appliances.

So, a skilled listing agent considers all the tangible factors such as features and amenities, as well as intangible factors such as benefits and appeal. He/she estimates what a normal buyer would be willing to pay based on the current market environment. An understanding of market trend is paramount. In an up-trending market, the last home that sold in the area is the base on price. In a down-trending market, the last home that sold is the ceiling on price. In a stable market, the last home that sold is a mirror on price.

I have to stop here. I hope the above description is helpful to you. For more details or an evaluation of your home, you can always call or email me.

Happy March!

We are looking to finish the first quarter of 2015 already. How time flies! The first two months of this year have been extremely robust in real estate. With increasing confidence in the economy, loosening of lending criteria, decrease in down payment requirement and loan costs, and still remarkably low interest rates, many people are looking to buy a home this year. We are working with many clients who are upsizing and downsizing. This may turn out to be a year of lateral-movers.

Alysa will share below why it’s a good time to buy a home right now.

Yien Yao

IS NOW A GOOD TIME TO BUY?

We are frequently asked “Is this a good time to buy a home?”

And, our answer is an emphatic “Yes, this is a GREAT time to buy a home!”

This is what we are seeing:

Overall, this is a great time to buy a home! Do you know anyone thinking of purchasing? Let us know, we would love to help them!

Alysa Yao

I want to remind everyone who has bought a home in 2014 to file for Florida homestead property tax exemption. If you own your home and it’s your primary residence, you may be entitled to a homestead exemption, which can save you around $750 and offer other benefits/protection.

The deadline to file an application for 2015 is March 2, 2015.

You must meet the following requirements as of January 1 of the year you are filing (for example, if you purchased a home in 2014 and live in it as of January 1, 2015, you now qualify).

(1) You have the title to the home, as recorded in Orange County Official Records.

(2) You live in this home.

(3) You are a permanent resident of Florida.

(4) You are a U.S. citizen or a Permanent Resident.

You may apply online, by mail, or in person. Use the link below, or call the number below for more information and forms.

Here is the link to the Homestead page of Orange County Public Appraiser’s website:

http://www.ocpafl.org/exemptions/HX_FAQ.aspx

RICK SINGH, CFA

Orange County Property Appraiser

Attn: Exemption Department

200 S. Orange Avenue Suite 1700

Orlando, FL. 32801

(407)836-5044

An important benefit of the Homestead Exemption is that the assessed value of your home, which is used to calculate your property taxes, cannot increase more than 3% per year. This offers crucial protection during the years of double-digit skyrocketing home prices. Homeowners with this protection did not see their property taxes go through the roof.

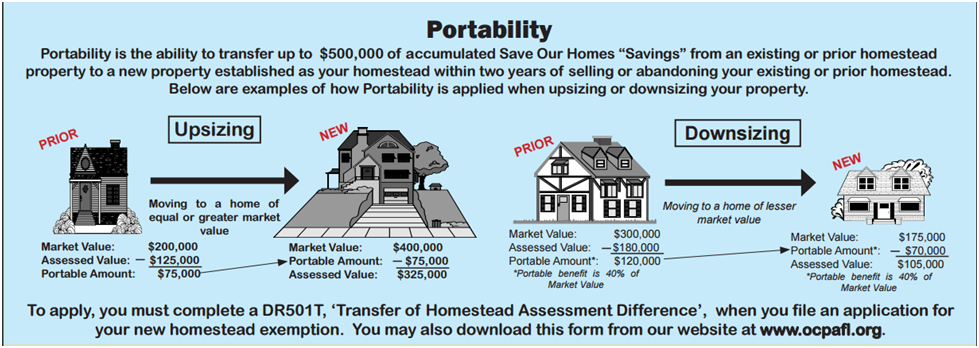

After a homeowner has stayed in a home for many years and enjoyed the capping of assessed value over the years, that homeowner may find him/herself “stuck” in this home and can’t afford the property tax increase if he/she moved to a different home. For this reason, “Portability” was introduced.

January is already behind us in this new year! As I sat down to write this month’s message, I looked at what I wrote last February for comparison. It’s amazing that the same things still apply. I am reading the message and it is as relevant today as when it was first written 12 months ago.

It’s been an extremely active month in the Orlando real estate market. This is seasonally expected. Everyone was busy with the holidays in November and December. In central Florida we do not get much of a snow-bird influx like our coastal cities. So it has been relatively quiet. Now the holiday season is behind us, sellers are seeking consultations for selling their homes, and buyers are inquiring to start their home shopping. In Orlando, this activity starts in January, and will continue to build momentum through the Spring and into the Summer.

Now having said that, what has gradually changed over the recent years, is that people tend to start looking earlier, and watch the market for a longer period of time. I believe this is a natural phenomenon resulting from the wide availability of information of homes for sale on the internet. People can browse online in the comfort of their homes, as well as gather information long before it’s time to start viewing homes in person. I routinely track online viewing hits of my listings. I can often see the numbers rise weeks before the actual showings increase.

The result is that we get inquiries on listings in any month, any season. We are able to fully market and create exposure for listings regardless of the season and market. My consultation focuses on the overall market trend (trending up, down, and sideways) rather than specific timing of a particular month. Because we are currently in a stable market where supply and demand are in balance, the listing timing is now based on seller’s personal and family situation and moving plan, rather than market timing.

For home buyers, more information is at their finger tips than ever before. The market place is flooded with information of mixed quality from a host of real estate websites. Some are useful, others can be flat out erroneous. We frequently look up properties our clients found from third-party websites and find them not for sale, already sold, or have misleading information. We also find our own listings on other websites with wrong information that we have no control over.

For the most accurate MLS search, start with our search engine at theyaoteam.com. We typically take the team approach with our buyer clients and evaluate properties together.

What can we provide for our clients as Buyer’s Agents when “everything” is on the internet?

The internet is a wonderful source of BULK information. Our expertise is in deciphering that, separating the fluff from the reality. We are your partners in knowing the local market, the trends, quality of specific products, advantageous mortgage financing, supervising the appropriate inspections, facilitating the closing, and in every other matter being the professional eyes and ears in the real estate world.

So far 2015 looks very promising for the continuing health of the housing market. With a stable market, we are working with more lateral movers (selling one home to buy another) than we have in many years. I will be reporting to you any significant developments over the course of the year. Other than national agenda everyone can follow in the news, such as interest rate trend, one thing on the local horizon that I will look for in 2015 is if the institutional investors will start to liquidate some of their holdings in Orlando. Their purchases that started in 2010/2011 can yield significant returns now.

Hope this is helpful to you. As always, if you have any real estate related questions, give us a call! We are happy to discuss real estate even when it’s not business. And, we love referrals!

Until next month, take care!

Yet another year has come to an end. We hope 2014 was a good and memorable year for you. As we enter 2015, we wish you the full optimism, energy, and momentum that comes with the arrival of a brand new year. We want to encourage you to create a New Year’s Resolution in writing. It’s been proven that when a goal is written down, you have a much higher chance of achieving it. We hope you will achieve all your goals and realize all your dreams in 2015!

Here are some suggestions for consideration in your real-estate related resolutions:

These are just some ideas. We have more! Happy New Year!

We want to wish you a happy, healthy, and prosperous New Year. We hope 2015 will be the year that you achieve significant landmarks in your life. May you reap the full benefit of the optimism and momentum that comes with the beginning of a new year to fuel your drive towards all your chosen goals.

The Yao Team is preparing for a great year ahead in the real estate market. We expect 2015 to be a year marked by a return to normalcy and balance. We’ve been watching the various market forces interact with one another throughout 2014. The housing supply and demand should balance each other out sometime in 2015 (see the Three-year History-Inventory chart below).

In a stable and balanced market without high appreciation potential, we expect investors will be a small segment of the market. Although, foreign buyers who worry about currency fluctuation or restrictions in their own countries still may want to invest in the more stable U.S. to preserve capital and they may still play a significant part in our market here. Otherwise, the majority of the market activity will be homeowner purchases. Generation Y buyers may start to overtake Generation X buyers as the largest group of homebuyers in 2015. Baby Boomers may start to downsize this year. We are already seeing a lot of first time homebuyers as well as lateral movers (selling a home and moving to another larger/smaller home).

Generally speaking, both buyers and sellers will be evenly leveraged. Sellers will be competing with others sellers on the price, quality, and desirability of their homes for sale. Buyers may not have more choices of homes per se (the inventory level may have reached a peak), but consistent influx of new listings gives the sense that “another home will come on the market soon”.

Speaking of homes coming on the market, now that we are in January, there is another interesting phenomenon on new listings I dubbed the “January Effect”. Take a look at the chart below. You can see there is a spike of new listings hitting the market in January from the low in December, year after year. We will be seeing this again this coming month.

Okay, I will stop here. As always, contact us if you have any real estate related questions. Each real estate situation is unique and we enjoy providing consultation with customized analysis and personalized plan. We look forward to chatting with you in 2015!

It’s the last month of 2014! Another year is coming to an end. We hope it’s been a good year for you, be it financial, professional, familial, personal, or simply individual & spiritual growth. It’s been another record year for us in real estate. Many of our clients this year have upsized, downsized, bought a first home, relocated, bought an investment property, or sold an investment property. Whatever the purpose and reason, we are honored to have been a part of the journey. Each and every journey we took with clients was special and memorable in some way. Real estate is likely the largest financial endeavor in our lives. We are grateful to have been entrusted to be the guides in this process.

The Orlando housing market has finally reached the realm of stability in 2014. The roller coaster years are behind us now. The prices have been consistent. The interest rate remained stable within a range of about 4-4.5% in 2014. Individuals’ circumstances are the main determinants of timing in this market. That means there aren’t a lot of external factors that significantly sways things one way or another, so people tend to make the move when they are ready without waiting for a particular event.

We will continue to report market conditions to you as we enter the coming new year. At this point, 2015 is projected to be another stable year in Orlando real estate. As we monitor global and national economic movements that will affect us, we will be your eyes and ears in the local real estate market. In a stable market without large swings, attention to minute details will make a difference in your real estate endeavors.

We sincerely wish you a truly wondrous holiday season. May you enjoy the fruits of your labor and the warmth of loved ones.